The dark web in 2025 looks very different from its early days. It has grown more sophisticated, harder to track, yet more visible than ever thanks to better data. Tor now sees millions of daily users, darknet markets move billions of dollars each year, and global access patterns are shifting, with countries once peripheral now becoming central.

Whether you’re a journalist, policymaker, or everyday internet user, these changes shape how we understand privacy, security, and risk online. In this blog, we’ll reveal how the dark web is being used in 2025, which countries are driving curiosity, and what the latest data reveals about access trends.

Global Usage: Who’s Accessing the Dark Web and From Where

When it comes to dark web access in 2025, the U.S. is way ahead of the pack. According to Tor Metrics, the U.S. alone accounts for over 1 million daily relay users, roughly a quarter of all relay traffic. Germany takes second place with nearly 600k users, and France comes in third with about 175k.

Interestingly, India has also climbed into the top 10, with more than 113k daily users, proving that curiosity about the dark web isn’t limited to the West anymore.

Here’s how the top countries stack up in 2025(Q1):

| Rank | Country | Daily Relay Users (Approx.) | Share of Relay Network |

| 1 | United States | 1,047,374 | 25.0% |

| 2 | Germany | 588,009 | 14.0% |

| 3 | France | 175,266 | 4.2% |

| 4 | Netherlands | 173,994 | 4.2% |

| 5 | Canada | 138,501 | 3.3% |

| 6 | United Kingdom | 116,341 | 2.8% |

| 7 | India | 113,061 | 2.7% |

| 8 | Lithuania | 102,421 | 2.4% |

| 9 | Russia | 101,439 | 2.4% |

| 10 | Spain | 97,600 | 2.3% |

Keep in mind, these figures only reflect relay users. Many people connect through bridges (used in censored regions or for extra privacy), so the real global user base is significantly larger.

Money Flows: Darknet Markets & Illicit Crypto

When you follow the money trail on the dark web, the numbers are staggering. According to Chainalysis, darknet markets alone pulled in just over $2 billion in Bitcoin transactions on-chain in 2024.

On top of that, specialized fraud shops, the kind that trade stolen identities and financial data, generated around $225 million in BTC. And it’s not just Bitcoin. Overall, illicit crypto wallets took in a staggering $40.9 billion last year.

To put this into perspective, TRM Labs reports that the total crypto transaction volume for 2024 was around $10.6 trillion, and only about $45 billion (≈0.4%) of that was linked to criminal activity, showing that while the dark web economy is big, it’s still a small fraction of the wider crypto ecosystem.

| Category | Value (USD) | Share of Total Crypto Activity |

| Total Crypto Transaction Volume | $10.6 trillion | 100% |

| Illicit Crypto Volume (overall) | $45 billion | ~0.4% |

| Darknet Market Flows (Bitcoin) | $2 billion | ~0.02% |

| Fraud Shops (Bitcoin) | $225 million | ~0.002% |

| Other Illicit Flows | ~$43 billion | ~0.38% |

What Dominates the Dark Web? A Category-Wise Look

The dark web isn’t a monolith, it’s a mix of different activities. At the top of the list is illegal file sharing (29%), where pirated software and copyrighted files are traded. Close behind is leaked data (28%), which shows just how common stolen credentials and breached databases are across hidden forums.

Financial fraud (12%) takes the third spot, including stolen credit card data, phishing kits, and banking scams. Meanwhile, news media (10%) plays a significant role, often representing censored journalism or whistleblower content that isn’t accessible on the surface web.

If you look further down, you’ll find promotional content (6%) and discussion forums (5%), which may not dominate in size but are crucial for advertising services and enabling anonymous exchanges.

Surprisingly, drugs account for only 4%, a sharp contrast to their infamous reputation. Finally, hacked accounts (3%), pornography (1%), and weapons (0.3%) make up the smallest slices of the ecosystem.

| Category | Share of Dark Web Content |

| Illegal File Sharing | 29% |

| Leaked Data | 28% |

| Financial Fraud | 12% |

| News Media | 10% |

| Promotional Content | 6% |

| Discussion Forums | 5% |

| Drugs | 4% |

| Hacked Accounts | 3% |

| Pornography | 1% |

| Weapons | 0.3% |

Dark Web Cryptocurrency Usage Trends

Cryptocurrencies remain the backbone of dark web commerce, but the landscape is shifting rapidly.

- Monero (XMR) dominates with 60% of all transactions, cementing its dominance thanks to its privacy-by-default design.

- Bitcoin (BTC) still accounts for 30%, mainly because of its widespread vendor support and easier liquidity.

- Altcoins like Zcash and Dash collectively account for around 5%, often favored for specific marketplaces.

- Ethereum-based tokens are carving a niche in fraud-as-a-service ecosystems, where smart contracts and tokenized services provide flexibility.

- More than 40% of vendors now rely on mixers/tumblers to obscure transactions, intensifying challenges for law enforcement.

- The average transaction value has climbed to $624, marking an 11% increase compared to 2024.

- Nearly 1 in 5 vendors (20%) now use dynamic crypto pricing, adjusting instantly with market volatility.

Active Dark Web Marketplaces

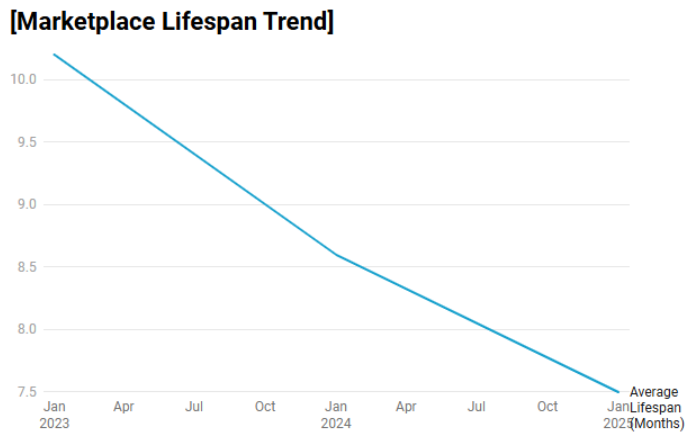

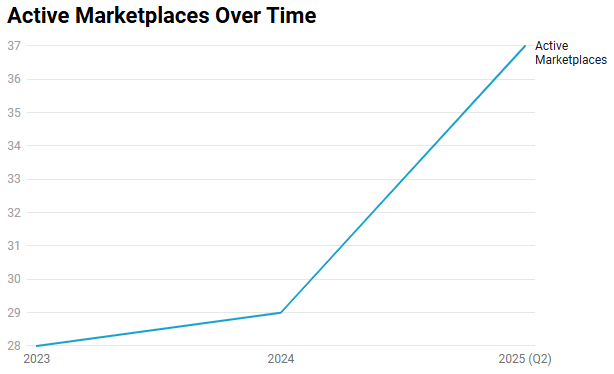

The dark web marketplace ecosystem in 2025 is volatile. Takedowns, scams, and law enforcement pressure are constant, yet the numbers keep climbing. As of Q2 2025, there are 37 known active marketplaces, a 28% increase from 2024.

Despite the churn, the top five platforms dominate, handling roughly 72% of all transactions. This concentration shows that while new entrants appear frequently, only a handful manage to attract significant user trust and volume. In fact, new markets are popping up every 3 to 4 weeks, proving that the cycle of closures and launches is alive and well.

Specialization is also reshaping the landscape. About 20% of marketplaces focus solely on data and identity theft services, while four major markets launched in 2025 revolve around digital crime tools like ransomware kits and AI-driven scrapers. This marks a shift from traditional drug-heavy markets to cybercrime-as-a-service hubs.

Another striking trend is marketplace turnover, the average lifespan is now just 7.5 months, making it difficult for users to rely on any single platform long-term. Adding to that, encrypted and mobile-friendly markets now account for 22% dark web traffic, which aligns with the rising adoption of Tor on smartphones.

Estimated Dark Web Revenues

The dark web continues to evolve into a multi-billion-dollar economy, with revenue streams diversifying far beyond the once-dominant drug trade.

In 2025, total global revenues from dark web activities are projected at $3.2 billion, showing how underground markets adapt and survive despite relentless law enforcement pressure.

| Category | Estimated Revenue (USD) | Key Insights |

| Illicit Drugs | $1.1 billion | Still the largest revenue stream, though its share is shrinking. |

| Fraud & Scam Services | $520 million | Includes phishing kits, fake IDs, mule accounts; drives identity theft. |

| Cybercrime-as-a-Service | $700 million | Ransomware kits, exploit builders, phishing templates; fastest-growing area. |

| Weapons & Counterfeit Docs | $250 million | Smaller in scale but high geopolitical and security risks. |

| Stolen Data Markets | $430 million | Selling hacked databases and personal records; demand is rapidly increasing. |

Vendor Earning Data

Behind the big revenue numbers are thousands of individual vendors, each running operations that range from small side hustles to large-scale enterprises. The earnings data highlights just how uneven, yet lucrative, this underground economy can be.

| Metric | Value | Key Insights |

| Average Vendor Earnings | ~$12,700 annually | Reflects the earnings of typical operators. |

| Top-Tier Operator Earnings | $400,000+ annually | On par with small legitimate businesses. |

| Geographic Share (2025) | US: ~30%, Russia & Germany follow | Shows concentration of activity in advanced economies and cyber hubs. |

Dark Web Intelligence: Market Size & Growth Trends

The dark web intelligence market is no longer a niche; it’s becoming a vital part of cybersecurity spending worldwide. With data breaches, ransomware, and credential leaks skyrocketing, businesses are looking for tools that continuously scan the dark web to detect stolen data before it’s exploited.

Several research firms have published forecasts, but their numbers vary widely because of how differently they define the scope of “dark web intelligence.”

Here’s a breakdown of the latest reports:

| Research Source | Estimated Market Size | Forecast & Growth | Key Insights |

| MarketResearchFuture | USD 1.38 billion by 2032 | CAGR ~15.17% (2024-2032) | Likely includes very broad definitions, software, services, and infrastructure. |

| The Business Research Co. | USD 0.63 billion in 2024 → USD 1.64 billion by 2029 | CAGR ~21.2% | Conservative estimate, focusing on monitoring solutions. |

| Market.US | USD 520.3 million (2023) → USD 2.92 billion by 2033 | CAGR ~21.8% | Includes enterprise services and security vendors. |

| Technavio | Growth of USD 1.15 billion expected from 2025-2029 | CAGR ~18.5% | Driven by AI-based monitoring and enterprise adoption. |

| IndustryARC | USD 2.07 billion by 2030 | CAGR ~21.8% | Covers both government and enterprise usage. |

What the Dark Web in 2025 Really Tells Us!

The 2025 dark web is not just about shady marketplaces, it mirrors the evolution of the internet’s underground economy. Usage patterns show that curiosity is spreading beyond the West, with India and other regions climbing the ranks. Financially, while billions flow through darknet markets, these numbers are still a tiny fraction of global crypto activity.

The real transformation lies in content and services. Drugs are no longer the dark web’s defining feature; instead, leaked data and cybercrime-as-a-service dominate. Monero has firmly overtaken Bitcoin, marketplaces are shorter-lived but more specialized, and mobile-friendly encrypted platforms point to where the ecosystem is heading.

At the same time, legitimate sectors like dark web intelligence are scaling rapidly, showing how cybersecurity vendors and enterprises are turning underground threats into actionable defense strategies. Your first line of defense is managing your privacy, and PureVPN’s Dark Web Monitoring can help by notifying you when your sensitive data appears on the dark web.

Frequently Asked Questions

According to Tor Metrics, over 4 million daily users connect to the Tor network. The U.S. leads with more than 1 million relay users, followed by Germany and France. However, these numbers only reflect relay traffic; total users are likely higher when bridges and alternative access methods are included.

Illegal file sharing (29%) and leaked data (28%) dominate dark web content, surpassing drug markets (just 4%). This shift highlights the growing demand for stolen databases, credentials, and pirated software.

Monero (XMR) is the top choice, powering 60% of dark web transactions thanks to its built-in privacy features. Bitcoin (BTC) remains important (30%), while niche use of altcoins like Zcash and Dash continues.

In 2025, revenues from dark web activities are estimated at $3.2 billion. Illicit drugs generate $1.1 billion, while cybercrime-as-a-service platforms account for $700 million. Fraud services, stolen data markets, and weapons trafficking make up the rest.

No, accessing the dark web through Tor or I2P is not illegal in most countries. However, engaging in illicit activities (like buying drugs, weapons, or stolen data) is against the law. Many journalists, researchers, and activists use the dark web for privacy, whistleblowing, or accessing censored information.

It refers to tools and services that monitor hidden networks for stolen credentials, leaked data, or emerging threats. According to The Business Research Company, this market could reach $1.64 billion by 2029, driven by enterprises seeking proactive cyber defense.